Have you ever bought something online only to realize later that it’s not quite what you wanted, but the return window slammed shut faster than your morning alarm? Oh, we’ve all been there. But guess what? Your credit card might secretly have your back. Enter: Extended Return Policies. That’s right—they’re like the superhero cape you didn’t know you had in your wallet.

In this post, we’ll dive deep into how extended return policies can save your budget (and sanity). You’ll learn what they are, why they matter, and how to leverage them effectively. Buckle up—because this could change the way you shop forever.

Jump Ahead:

- What Are Extended Return Policies?

- Why You Need Them for Smart Spending

- Step-by-Step Guide to Unlocking These Benefits

- Pro Tips to Maximize Your Coverage

- Real-Life Examples of Saved Purchases

- Frequently Asked Questions About Return Protection

Key Takeaways

- Credit cards often offer extended return protection beyond store policies.

- Not all purchases qualify; exclusions apply.

- You need proof of purchase and timely action to file a claim.

- This perk is underutilized and can save hundreds annually.

What Are Extended Return Policies?

Let’s break it down. Some credit cards come with a little-known benefit called “return protection” or “extended return policies.” If a retailer denies your return because their policy expired, certain credit cards will step in and refund you—up to a limit—if the item meets specific criteria.

For instance, if you purchased an air fryer during Black Friday but changed your mind three months later when the store’s 90-day return window closed, your credit card might still cover the cost. It’s almost too good to be true, isn’t it? Almost.

Why You Need Them for Smart Spending

Here’s where I admit my own fail: Once, I accidentally returned a pair of shoes after Christmas—only to find out they weren’t eligible because the store’s holiday return policy ended December 26th. Ugh. Lesson learned: Retailers love loopholes. That’s why leveraging your credit card’s extended return policy gives you a safety net against those sneaky restrictions.

Imagine extending that peace of mind to every big-ticket purchase—electronics, furniture, even jewelry. Instead of worrying about timelines or rigid store policies, you simply focus on using what you buy. Sounds liberating, doesn’t it?

Grumpy Optimist Dialogue:

Optimist You: “This means I never have to stress about returns again!”

Grumpy You: “Don’t get cocky. Read the fine print first.”

Step-by-Step Guide to Unlocking These Benefits

Ready to master this financial hack? Here’s how to get started:

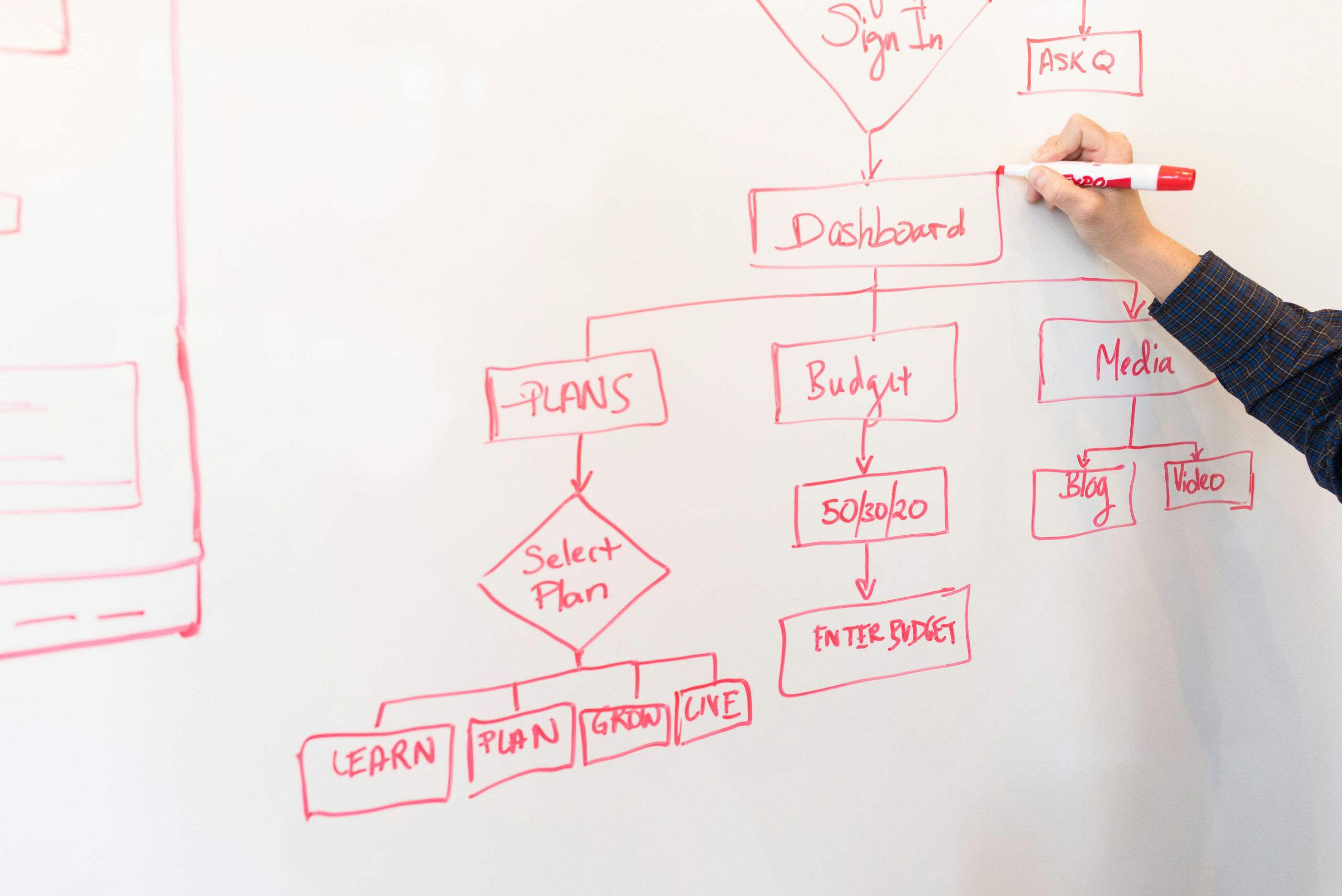

1. Check Your Credit Card Perks

Log into your account or review your card agreement to see if your issuer offers return protection. Look for terms like “Return Guarantee” or “Purchase Assurance.” Don’t skip this step—it’s crucial!

2. Keep Receipts & Track Deadlines

File away physical receipts or save digital copies. Most programs require claims within 60–90 days of the original purchase date. Pro tip: Set calendar reminders so you don’t miss deadlines.

3. Gather Proof of Rejection

If the store won’t take your return, document everything. Snap photos of the item, keep communication records, and note any rejection reasons from customer service.

4. Submit Your Claim Online or Via Mail

Every program differs slightly, but most require submitting forms alongside supporting documents. Double-check requirements before sending anything off—you don’t want to waste time.

Pro Tips to Maximize Your Coverage

- Know the Limits: Most plans cap reimbursements at $250–$500 per item, with annual maximums around $1,000–$3,000.

- Avoid Exclusions: Items like perishables, custom-made goods, and cars usually aren’t covered. Yep, no refunds on that new Ferrari.

- Prioritize Cards with Strong Policies: American Express, Visa Signature, and Mastercard World Elite cards frequently lead the pack here.

Real-Life Examples of Saved Purchases

Tina, a teacher from Ohio, was thrilled to discover her Chase Sapphire Preferred® Card reimbursed her $400 smartwatch after the manufacturer refused a late return. Meanwhile, Matt in California used his Amex® Gold Card to recover nearly $800 worth of mismatched furniture sets. Moral of the story? People who check their benefits win.

Frequently Asked Questions About Return Protection

Is This Benefit Free?

Yes! It’s included as part of your credit card perks—no extra fees required. Score one for capitalism.

Does Every Card Have This Feature?

Nope. Premium cards tend to include better return programs than basic ones. Always verify before swiping.

Can I Stack Store Returns with My Card Policy?

Unfortunately, no. Stores typically handle initial returns, while your card acts as a backup plan.

Conclusion

Whew—that was a lot! To recap:

- Credit card return protection extends the lifespan of traditional store return windows.

- Use these perks wisely by understanding limits, exclusions, and timelines.

- With minimal effort, you can save hundreds—and avoid buyer’s remorse altogether.

Now go forth and conquer those pesky return deadlines like the savvy spender you are. Chef’s kiss.

And remember, just like pogs in the ‘90s, some trends are fleeting—but smart financial habits stand the test of time.

P.S. Did you know Tamagotchis made a comeback? Just saying… stay tuned for more throwbacks like this blog!